Freelance Emergency Fund: How Much to Save & How to Save Fast

Freelance Emergency Fund: How Much Do You Really Need? (And How to Save It Fast): As a freelancer, securing a robust emergency fund is crucial; aim for 3-6 months of essential expenses to cover income gaps and unexpected costs, and aggressively save by budgeting, automating savings, and seeking additional income streams.

Navigating the freelance world requires resilience and a safety net. Understanding the importance of a freelance emergency fund: how much do you really need? (and how to save it fast) is your first step towards financial security.

Why a freelance emergency fund is non-negotiable

Freelancing offers flexibility and autonomy, but it also brings uncertainty. Unlike traditional employment, income can fluctuate, and benefits like paid sick leave are often absent. An emergency fund acts as your financial shield, providing peace of mind and a buffer against unforeseen circumstances.

Income fluctuation

Freelancers experience varied income levels. Some months bring abundance, while others might be lean. An emergency fund ensures you can cover your essential expenses during slower periods without resorting to debt or compromising your financial stability.

Unexpected expenses

Life is unpredictable, and freelancers are not immune to unexpected expenses such as medical bills, car repairs, or home emergencies. Having an emergency fund readily available allows you to handle these costs without derailing your long-term financial goals.

Lack of traditional benefits

Freelancers typically don’t receive benefits like paid time off or employer-sponsored health insurance. If you fall ill or need to take time off, an emergency fund can replace lost income and cover necessary healthcare costs.

An emergency fund can make or break a freelance career when things get really bad. The amount of protection it offers you is worth the effort of building it up as quickly as possible.

Determining your ideal emergency fund size

Calculating the right amount for your emergency fund involves assessing your monthly expenses and considering the stability of your income. A general guideline is to save three to six months’ worth of essential living expenses.

Calculate monthly expenses

Start by calculating your average monthly expenses. Include necessities such as rent or mortgage payments, utilities, groceries, transportation, insurance, and any recurring debt payments. Be realistic and include everything that is necessary to maintain your lifestyle.

Assess income stability

Evaluate the stability of your income. If your freelance work is consistent and predictable, you might lean towards the lower end of the recommended range (three months). If your income is highly variable, consider saving closer to six months’ worth of expenses.

Factor in personal circumstances

Consider any unique circumstances that might warrant a larger emergency fund. For instance, if you have dependents, chronic health conditions, or live in an area with a high cost of living, increasing your savings target is prudent.

- Look at your outgoings: Track expenses to determine actual spending.

- Consider job market: If your skills are in demand, you might need less saved up.

- Be honest: Account for all possible costs, don’t leave anything out.

Calculating the right size for your emergency fund is a balance between preparing for potential setbacks and maintaining reasonable financial flexibility. There is an element of future-proofing involved.

Practical steps to save efficiently

Once you know how much you need an emergency fund for, the next goal is to fill it as quickly as possible. Several strategies can help you reach your savings target more efficiently.

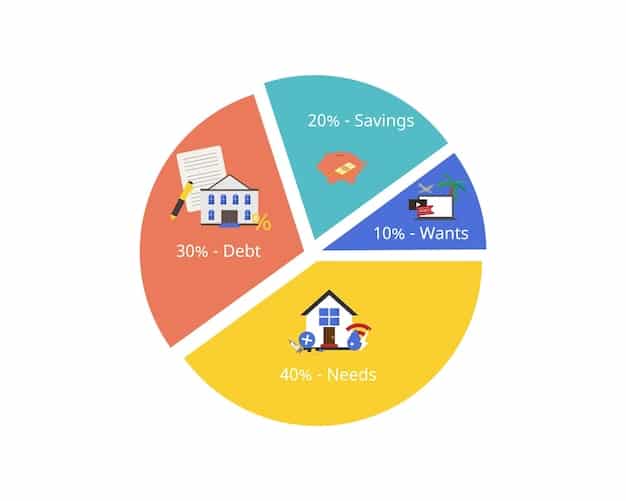

Create a budget

Develop a detailed budget to track your income and expenses. Identify areas where you can cut back on spending and allocate those savings towards your emergency fund. Tools and apps can make budgeting easier and more effective.

Automate your savings

Set up automatic transfers from your checking account to a dedicated savings account for your emergency fund. Automating this process ensures consistent contributions without requiring manual effort. Many banks offer this feature for free.

Increase your income

Explore ways to increase your income, such as taking on additional freelance projects, offering new services, or pursuing part-time work. All extra income should be saved into your emergency fund.

Saving doesn’t have to be painful. By being disciplined and finding what works for your circumstances, you can ensure you are building up an appropriate emergency fund.

Leveraging budgeting apps and tools

Utilizing budgeting apps and digital tools can greatly streamline your savings efforts. These resources offer features such as expense tracking, goal setting, and automated savings plans.

Mint

Mint is a popular budgeting app that consolidates your financial accounts in one place. It tracks your spending, helps you create a budget, and sends alerts when you’re overspending. This real-time visibility makes it easier to identify areas where you can save more money.

YNAB (You Need a Budget)

YNAB is a budgeting tool that emphasizes proactive spending. It encourages you to allocate every dollar a job to managing your money effectively. YNAB also offers educational resources and support to help you improve your money management skills.

Personal Capital

Personal Capital provides a comprehensive overview of your finances, including budgeting, investment tracking, and retirement planning. It offers insights into your spending habits and helps you identify opportunities to optimize your savings. This can be an excellent tool if you handle large amounts of money.

- Budgeting apps can help: Automate savings and track expenses.

- Find one that works for you: There are plenty on offer so pick the one that suits you best.

- Use the data: These apps generate data that can give huge insight into your spending.

Budgeting apps and tools can be incredibly helpful in managing your finances and accelerate your freelancing businesses.

Smart side hustles to boost emergency savings

Incorporating side hustles into your freelance routine is a smart way to enhance your income. Look for side hustles that offer flexibility and align with your skills and interests.

Online tutoring

If you have expertise in a particular subject, consider offering online tutoring services. Platforms like TutorMe and Chegg Tutors connect you with students seeking help. Tutoring can be done remotely, fitting around your schedule and helping you make extra money.

Freelance writing or editing

Leverage your writing skills by offering freelance writing or editing services to businesses and individuals. Content creation is in high demand, and platforms like Upwork and Fiverr can help you find clients. You could be earning money simply through your words.

Virtual assistant services

Many businesses need virtual assistants to help with tasks such as scheduling, email management, and social media management. If you are organized and detail-oriented, offering virtual assistant services can be a lucrative side hustle and boost your expertise.

Finding a side hustle that you enjoy is an extremely important thing for freelancers to do. If you are able to find a way of earning extra money that is also enjoyable for you then saving can be quick.

Maintaining and replenishing your fund

Building an emergency fund is just the first step. It’s equally important to maintain and replenish your fund over time to ensure it remains adequate for your needs. Plan to keep it topped up.

Regular check-ins

Periodically review your expenses and income to ensure your emergency fund aligns with your current financial situation. Adjust your savings target if your circumstances change, such as increased expenses or decreased income.

Avoid dipping into it unnecessarily

Reserve your emergency fund for genuine emergencies. Avoid using it for non-essential expenses, as this can deplete your savings and leave you vulnerable when a real crisis occurs. It can sting to use the money that you have been working so hard to save.

Replenish after use

If you do need to use your emergency fund, make it a priority to replenish it as soon as possible. Create a plan to rebuild your savings by allocating a portion of your income each month until you reach your target amount: If you keep this target in mind then you can’t go wrong.

Remember, an emergency fund is more than just a lump sum of money; it’s a testament to your financial preparedness and resilience.

| Key Point | Brief Description |

|---|---|

| 💰 Determine Fund Size | Calculate 3-6 months of essential expenses |

| 📊 Create a Budget | Track expenses and cut back where possible. |

| Automate Savings | Set up automatic transfers to a savings account. |

| 💼 Consider Side Hustles | Increase income through tutoring, writing, or VA services. |

Frequently Asked Questions

▼

Freelancers should aim to save 15-20% of their income to cover taxes, retirement, and emergency savings. However, this depends on the work and income. Work towards the highest percentage to be safe.

▼

The emergency fund should be reserved for unexpected expenses like medical bills, job loss, or car repairs. Avoid using it for non-essential purchases that could be covered by your regular income.

▼

Keep your emergency fund in a high-yield savings account or money market account. These accounts offer higher interest rates than traditional savings accounts but still allow easy access to your funds.

▼

Budgeting apps help freelancers track income and expenses, create budgets, and automate savings. They provide real-time visibility into your finances, helping you make informed decisions and save more effectively.

▼

Reliable side hustles for freelancers include online tutoring, freelance writing, virtual assistant services, and freelance consultancy advice. Look at what tasks and services you can offer that you enjoy.

Conclusion

Building a robust emergency fund is an essential step for any freelancer aiming for financial stability. Start today to secure your financial future.